Cities

Cities In the U.S. Where Selling A Home Comes At A Cost

Selling a home can be a gamble, and for some homeowners in the U.S., it’s not paying off. Due to changing economic conditions and market imbalances, many are offloading for less than they expected. Want to know where these losses are hitting hardest? Here are 10 cities where homeowners are transacting below expectations and losing out financially.

Austin, Texas

Austin’s housing market grew rapidly due to tech industry expansion and population gains. Recently, rising mortgage rates and market corrections have caused price declines, which have led some homeowners to sell at a loss, especially those who purchased near peak prices. However, the city continues to attract buyers amid ongoing market adjustments.

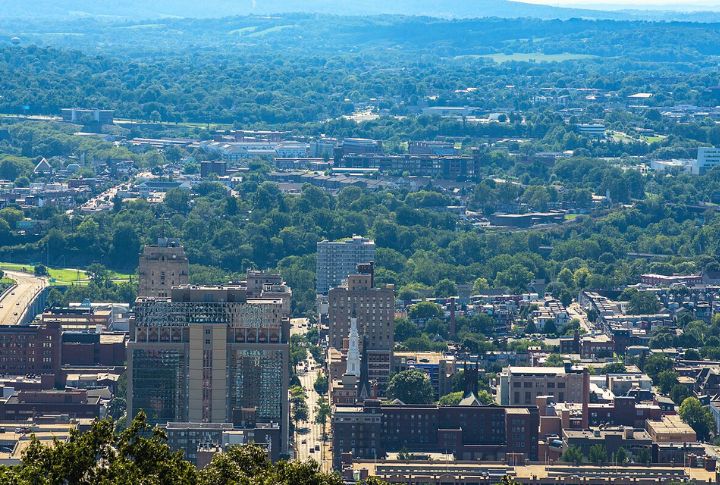

Rochester, New York

Rochester’s shrinking manufacturing base and population decline have weakened its housing market. Low demand and high inventory force homeowners to sell below purchase prices, causing financial losses. This trend has slowed new construction and dampened local investment, further challenging the city’s economic recovery and housing stability.

Reading, Pennsylvania

Reading continues to face economic recovery challenges that have significantly impacted its housing market. Persistent job losses and limited new investment have contributed to declining home values. Additionally, high vacancy rates and aging housing stock further pressure property values in the area.

Detroit, Michigan

Ever wonder why Detroit’s housing market is still struggling? Despite efforts to revitalize the city, high unemployment and market challenges make it tough for homeowners to sell at a profit. Ongoing difficulties have slowed neighborhood recovery and contributed to continued instability in the housing market.

Cleveland, Ohio

Widespread foreclosure rates and financial stagnation have weighed heavily on Cleveland’s housing market. With buyer interest low, sellers often reduce listing prices to attract offers. Limited demand and persistent market pressures continue to suppress home values, making a recovery in the housing market slow and uncertain.

Miami, Florida

Miami’s once-booming condo market is cooling fast. With luxury units flooding the market and mortgage rates climbing, many sellers are accepting offers below what they paid. The result? Losses are stacking up, and both investors and homeowners are taking financial hits just to offload stagnant properties.

San Francisco, California

A shift toward remote work and elevated borrowing costs has deflated San Francisco’s housing demand. Fewer buyers mean longer listing periods and softer offers. As sale prices drop below prior purchase values, homeowners are increasingly closing at a loss, reflecting broader market hesitation.

Chicago, Illinois

Chicago’s real estate sector faces pressure from high property taxes and ongoing economic uncertainty. Neighborhoods that were once in high demand are seeing price drops as property owners are forced to lower expectations. The overall real estate market in Chicago has slowed, and homeowners face fewer buyers and weaker offers, which drives prices down.

Phoenix, Arizona

Phoenix has seen rapid expansion in recent years, but now the market is facing overbuilding in certain areas. As mortgage rates climb and demand decreases, homeowners are finding it difficult to sell for a profit. This slowdown has also caused new construction projects to pause, impacting local jobs and slowing economic momentum.

New Orleans, Louisiana

Just imagine trying to sell a home in New Orleans while still facing the effects of Hurricane Katrina. Areas with lingering storm damage and high insurance costs struggle to recover. Property owners often must accept offers below their original purchase price, which makes it tough to regain financial footing in these hard-hit neighborhoods.