Every year, scammers focus on stealing personal info and money, and they often set their sights on older folks. In fact, victims of financial exploitation among seniors lose a whopping $28.3 billion every year, according to a 2023 BankSafe report from AARP. If you haven’t crossed paths with a scammer yet, you might encounter one in the near future. Here are 15 common scams that target seniors.

Phony Sweepstakes or Lottery Wins

Scammers love to prey on the excitement of winning. They’ll send you a letter or call saying you’ve won a huge cash prize. The twist? They’ll ask for an “activation fee” or personal info to claim your prize. But here’s the truth: No legitimate lottery or sweepstakes ever asks winners for money upfront. If you didn’t enter, it’s definitely a scam.

IRS Tax Scams

Picture this: you get a call from someone claiming to be the IRS, telling you that you owe back taxes and need to pay right away. They might even threaten arrest or legal action. However, the IRS never calls to demand immediate payment. They send letters first, and you’ll have plenty of time to sort things out. Always hang up and call the IRS directly if you get a suspicious call.

Grandparent Scam

This one is emotional. A scammer calls, pretending to be a grandchild in trouble, saying they’ve been arrested or are stranded and urgently need money. They’ll try to rush you into acting without thinking. Scammers often know personal details about your family, so don’t be fooled by their “inside knowledge.” Always call the grandchild directly (or a family member) to confirm.

Phony Health Insurance Offers

Seniors are primarily targeted with fake calls or emails that offer cheaper or better health insurance plans. The scammer will ask for all kinds of personal details, promising huge savings. If you didn’t contact them, it’s almost certainly a scam. When it comes to health insurance, always deal directly with trusted providers or government programs like Medicare.

Romance Scams

This one can be heart-wrenching. Scammers make fake profiles on dating websites or social media and pretend to be someone looking for love. After developing a “relationship,” they’ll start asking for money by saying that there’s an emergency or travel issues. What’s wild is that these scammers often know how to charm people by playing on their loneliness or emotions.

Pyramid or Multi-Level Marketing (MLM) Scams

These scams are dressed up as legit businesses that promise an easy way to make money. They might sell products, but the real cash flow comes from roping in other people to join, not from the actual sales. Most of the time, only the people at the top make any real money, while everyone else gets left hanging. MLMs might technically be legal, but they often run like pyramid schemes—super risky and usually bad news.

Tech Support Scams

Here’s one where tech-savvy scammers take advantage of those who aren’t so familiar with computers. You might get a pop-up that looks like it’s from Microsoft or Apple, telling you your device has a virus. Then, they’ll ask you for remote access to “fix” it. The truth? Most pop-up alerts are fake and used as a way for scammers to steal personal data or install malicious software.

Fake Charities

Scammers often capitalize on your kindness and pretend to represent a well-known charity after a big disaster or around holidays. They’ll say you can donate online or over the phone, but the money ends up in their pockets. Fun tip: If a charity’s name sounds shady or too new, look it up online. Real organizations will have a registered charity number you can verify.

Home Repair Scams

If a stranger knocks on your door offering cheap or urgent home repairs, beware! They may pressure you into paying upfront for work they never actually do. Some scammers claim your roof is leaking or your foundation is cracked, but it’s all a lie. Did you know? Many states require home improvement companies to be licensed, so ask for proof before handing over any money.

Timeshare Scams

Timeshares can be confusing, and scammers know that. They’ll approach you with offers to “buy back” or “sell” your timeshare for a huge profit. In reality, most timeshare resales are worth much less than what you paid. And the scammers? They disappear with your money before you know it. Always be careful with unsolicited timeshare offers—research them thoroughly.

Investment Scams

Imagine someone offering you a “too good to be true” investment opportunity. They may promise returns of 20% or more, even though most investments are much more modest. If it sounds too good to be true, it’s definitely shady. Scammers will ask for personal details, like bank accounts or Social Security numbers, to steal your information or money. Always chat with a professional financial advisor before making big decisions.

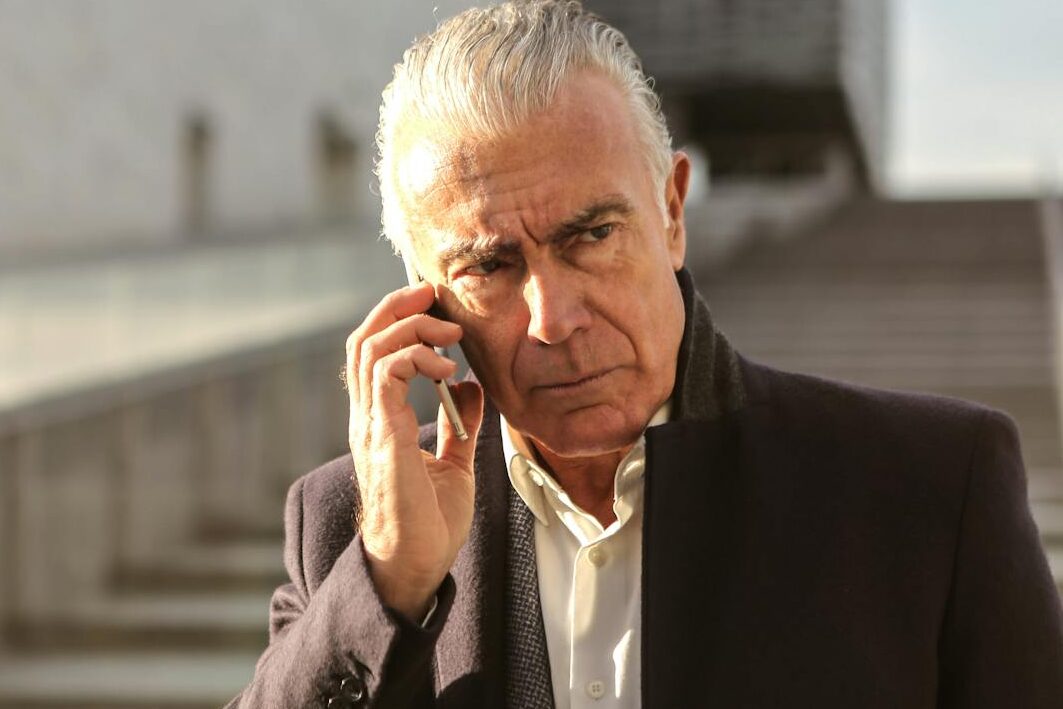

Credit Card Scams

Fraudsters love to pretend they’re calling from your credit card company and tell you something like your account has been compromised. They’ll ask for your card number and personal details to “verify your identity.” A real credit card company will never call you for this info. If you get a call like this, hang up and call the number on your actual card to check.

Medical Equipment Scams

Some scammers offer “free” or discounted medical equipment, like hearing aids or mobility aids, but the catch is they ask for your personal information or charge hidden fees. Here’s a good tip: If you didn’t ask for the equipment, be super careful. Check the company online and see all customer reviews before agreeing to anything.

Fake Prize or Gift Card Scams

This scam usually pops up as an email or text saying you’ve scored a “free” prize. The catch? You’ve got to buy gift cards or pay for shipping to claim it. Scammers love using gift cards because they’re almost impossible to trace. Pro tip: no legit contest or giveaway will ever ask you to shell out for gift cards to get your prize.

Debt Relief Scams

Debt can be super stressful—we all know about it. Scammers know this, too, and they offer quick fixes, like cutting down your debt for a fee. But they usually take your money and do absolutely nothing and then leave you in an even bigger mess. If you’re dealing with debt, go with trusted, government-backed programs or legit financial counselors who can actually help.