Money

10 Tax-Friendly States That Make Homeownership More Affordable

Every homeowner knows the purchase price is just the beginning. Property taxes can differ drastically depending on where you live, and in some states, they’re surprisingly low. If you’re looking to relocate or just curious where your dollar stretches further, here are 10 states where owning property won’t mean losing peace of mind.

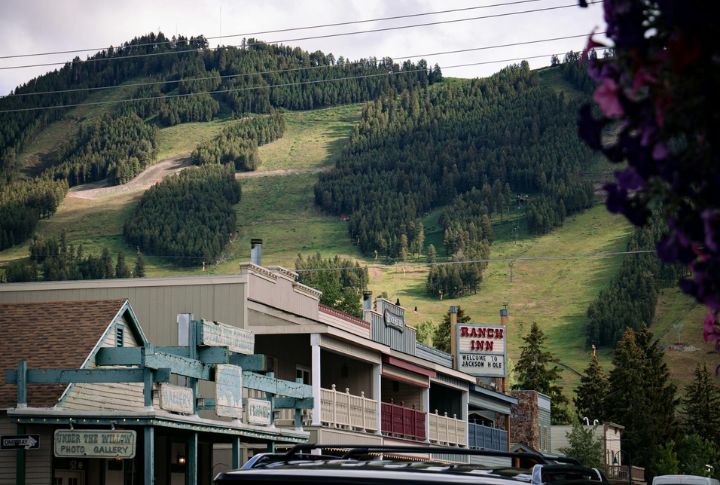

Wyoming

Wyoming isn’t just stunning—it’s also one of the most tax-friendly states out there. With property tax rates hovering around just 0.55%, it’s easy on your wallet. Picture this: sweeping mountain views, wide-open skies, and barely-there taxes. What’s not to love about that combo?

South Dakota

In South Dakota, property taxes are notably low, thanks to a state constitution that limits annual tax increases. The average property tax rate is around 1.01%, which is significantly lower than many other states. With no income tax and lower costs overall, South Dakota has become a hotspot for budget-conscious homeowners.

Alaska

Low property taxes and annual cash payouts? That’s just part of the deal in Alaska. Alongside its breathtaking wilderness, the state features one of the U.S.’s lowest average property tax rates, standing at just 1.07%. Add in the Permanent Fund Dividend—an annual check for residents—and you’ve got a place where your money stretches as far as the horizon.

Alabama

Down in Alabama, you can enjoy the warm southern vibes and pay almost nothing in property taxes. With rates at just 0.36%, Alabama makes it easy to own a home, all while basking in that southern charm. Who knew low taxes and Southern hospitality went so well together?

Mississippi

Mississippi has long been recognized for its affordable cost of living, and property taxes are no exception. The state’s average property tax rate is just 0.70%, well below the national average. If you’re looking for a place to settle down without breaking the bank, Mississippi offers great savings.

Louisiana

The State of Louisiana offers some of the most reasonable property tax rates in the country, with an average rate of 0.51%. Thanks to the local government’s tax relief programs, homeowners in Louisiana can benefit from lower property taxes even if their home’s value increases.

Arkansas

In Arkansas, homeownership is made easier by the state’s low property tax rates, averaging around 0.63%. With a cost of living lower than the national average and tax-friendly policies, this southern state is becoming a go-to for people looking to maximize their budget while maintaining a high quality of life.

West Virginia

Tired of high taxes and craving mountain views? West Virginia might be calling your name. With a low property tax rate of just 0.55%, it offers more room in your budget—and more room to roam. If you’re all about outdoor living and keeping more of your hard-earned money, this could be the perfect place to settle down.

Kentucky

Property taxes in Kentucky are typically around 0.74%, which is well below the national average. The state’s low cost of living and affordable housing market make it an excellent choice for homebuyers looking to enjoy their home without high tax burdens. Kentucky’s charm also adds to the appeal for those seeking a more relaxed lifestyle.

Tennessee

Tennessee rounds out the list with property taxes averaging around 0.48%. Thanks to its lack of income tax, Tennessee continues to attract people from all walks of life. Whether you’re a retiree or a young family, Tennessee offers a budget-friendly approach to homeownership and an overall low-tax environment.