Your wallet holds more than just cash—it’s a storage for personal items that could put your security at risk. Carrying sensitive items can lead to unnecessary risks. Here are 20 items you should never keep in your wallet or purse to safeguard your security and privacy.

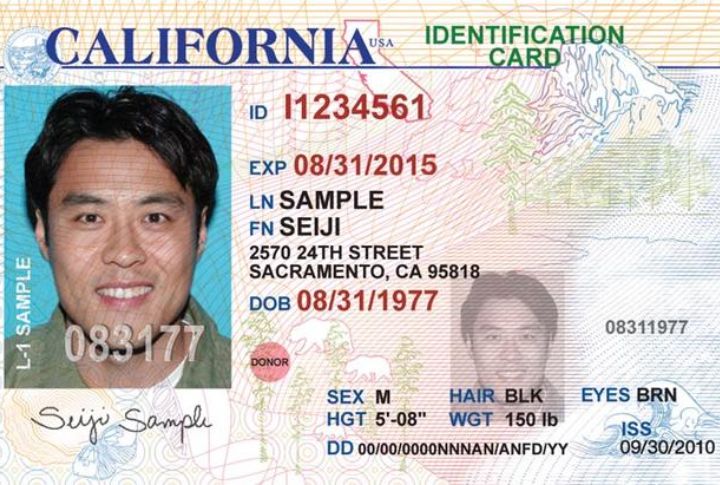

Expired Identification Cards

Holding onto expired IDs is more than inconvenient—it could lead to embarrassing situations. An expired ID is often refused at stores, airports, or even banks. Fun fact: The U.S. Department of Homeland Security suggests keeping your ID current to avoid complications.

Vehicle Registration Documents

Carrying vehicle registration documents in your wallet is a bad idea. If lost, these can be misused to forge ownership. Instead, keep them securely in your car’s glove compartment or a locked file at home to ensure your car remains safe.

Hotel Key Cards

Hotel key cards often store encrypted information about your stay, such as your room number and check-out details. Losing one could give someone access to your room. Always return key cards to the hotel front desk or destroy them after use.

Bus/Metro Cards (With Balance)

Public transport cards with pre-loaded balances are convenient but risky to carry unnecessarily. If lost, the funds are often unrecoverable. Keep only one active card in your wallet and store backups in a safe location to minimize financial loss.

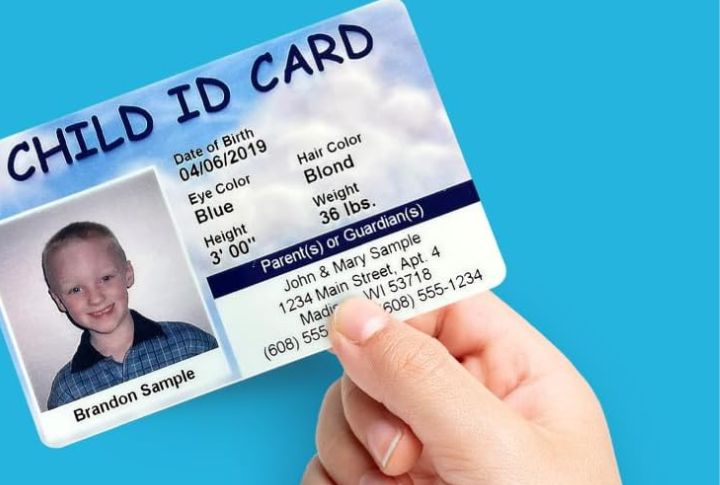

Children’s Information

Keeping your child’s school ID or report cards in your wallet might seem practical, but it poses serious risks. It could expose them to identity theft when stolen. Protect their privacy by storing such items securely at home or in a digital format.

Expired Coupons

Expired coupons are worthless, yet so many people still carry them. Why hold onto something you can’t use? Holding expired coupons not only causes inconvenience but also contributes to wallet clutter. Toss them out and keep only the ones with an expiration date that still serves you!

Spare SIM Cards

It’s better to store spare SIM cards in a secure and separate location, away from your wallet, to reduce the risk of misuse. If stolen, SIM cards can be exploited for unauthorized calls or identity fraud. Keeping them safe ensures better control over your mobile identity.

Loose Change

That extra handful of loose change can take up unnecessary space. The Bank of America reports that Americans carry an average of $10 in loose change daily—money that could be better spent or stored in a coin purse. Keep your wallet tidy and make your change work harder.

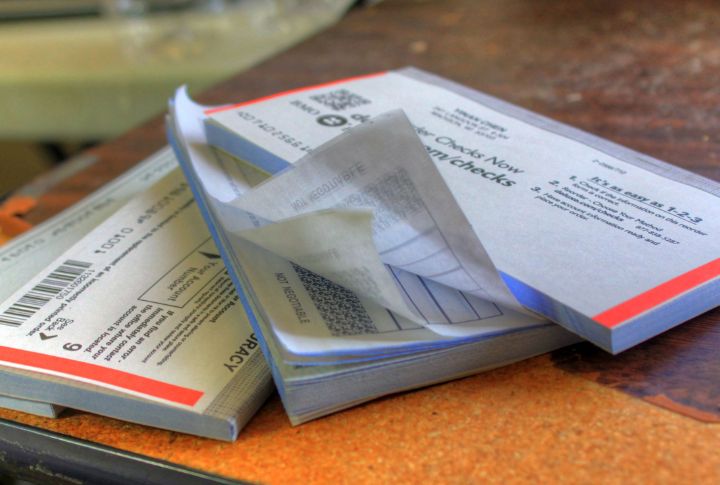

Checkbooks

Checkbooks are increasingly outdated and bulky. According to financial experts, carrying a checkbook in today’s digital world is risky, as lost or stolen checks can lead to swindling. It is recommended to use digital payments instead, as they are safer and free up space in your wallet.

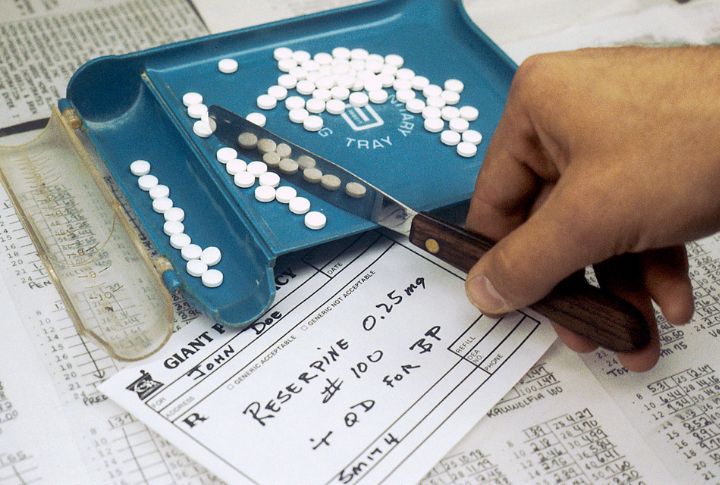

Prescription Medication

Carrying prescription meds in your wallet might seem convenient, but if they get misplaced, it can be a disaster. Medications need to be stored properly to maintain their effectiveness. Always keep them in their original packaging, and leave them out of your wallet when possible.

Unprotected Digital Wallet QR Codes

A digital wallet QR code in your wallet might grant direct access to your financial accounts. If misplaced, anyone could exploit it for unauthorized transactions. Make sure you secure such codes in encrypted apps or avoid carrying them physically altogether.

Debit Card PIN Code

It’s a huge red flag if your debit card PIN is written on a slip of paper in your wallet. The Federal Reserve highlights this as one of the most common causes of financial issues. Always memorize your PIN or use a secure app to store it—never write it down in your wallet.

Infrequently Used ID Cards

Those old membership or club IDs? They’re doing nothing but taking up space in your wallet. Keeping unused IDs might seem harmless, but they only add clutter. You’re better off leaving them at home and only carrying the essentials that you need every day.

Bank Account Information

Carrying a paper with your bank account number is a high-risk move. This information, in the wrong hands, can lead to unauthorized transactions. Memorize key details or store them in a secure digital app to avoid financial vulnerabilities.

Unnecessary Photos

While photos of family or pets bring joy, having too many can also weigh down your wallet. These photos are more likely to get damaged or lost. Instead, save these precious memories digitally so your wallet stays lighter and your photos stay safe and intact.

Extra House Keys

Spare keys shouldn’t take up valuable wallet space. If your wallet is stolen, not only does your ID go missing, but your house key might also be in the wrong hands. Keeping a spare key in your wallet can lead to unwanted security risks. Consider using a secure key holder instead.

Unprotected Tax Documents

It’s a big mistake to carry tax documents in your wallet. The IRS warns that tax documents contain sensitive personal information that thieves could easily exploit. It’s better to store them in a safe, digital format or a locked drawer, keeping your wallet free of unnecessary paperwork.

Emergency Contact List

While handy, an emergency contact list in your wallet can expose friends’ or family members’ details if lost. Save these numbers on your phone or in a secure app to avoid compromising their privacy while still staying prepared.

Unnecessary Loyalty Program Cards

Studies show that people carry around an average of 4 to 6 loyalty cards they never use. Avoid the temptation to carry; digital alternatives like apps or digital wallets make physical cards unnecessary.

Personal Letters or Notes

Personal letters in your wallet can reveal intimate details about your life. If lost, these could expose sensitive information. Hold personal correspondence in a safe place to maintain your privacy and avoid unnecessary embarrassment.