Money

10 Money-Smart Practices Worth Reviving Today

If money could talk, it’d probably ask why everyone ditched the habits that actually worked. Smart saving used to be common sense, not a lost art. Somewhere along the line, we got lazy and let convenience take over. Some of those forgotten money moves are exactly what we need now. Here are the smart habits worth bringing back.

Using Cash Envelopes For Budgeting

The envelope budgeting system dates back to the early 1900s. It separates cash into categories like groceries, rent, or gas. When an envelope runs out, spending pauses. This method promotes spending control and builds strong savings habits by forcing users to stick to a plan.

Waiting Until You Can Afford It

Learning to wait until you can truly afford something is a quiet strength. Previous generations prioritized saving over borrowing, sometimes viewing debt as a burden to avoid. Their patience built stable homes and lasting legacies, free from interest and stress.

Saving Windfalls, Not Spending Them

Past generations saved any extra money—bonuses, gifts, or tax refunds. The goal was to grow emergency savings or support retirement. This habit, once known as “saving for a rainy day,” has faded. Today, only 29% of Americans still put their tax refunds aside—but it remains a habit even Warren Buffett follows.

Fixing Things Instead Of Replacing Them

There was a time when people fixed things instead of tossing them. Clothes got patched, toasters repaired, and even old cars tuned up. It saved cash and waste. During WWII, this became a movement: “make do and mend.” Today, repair videos on YouTube have over 250 million views. Clearly, this habit still hits home.

Buying In Bulk And Preserving Food

Before modern refrigeration, families preserved harvests through canning and root cellars. Buying dry goods in bulk reduced costs and trips to the store. These habits resurfaced in the 1970s with bulk clubs, and as food waste rises again, they’re still worth bringing back today.

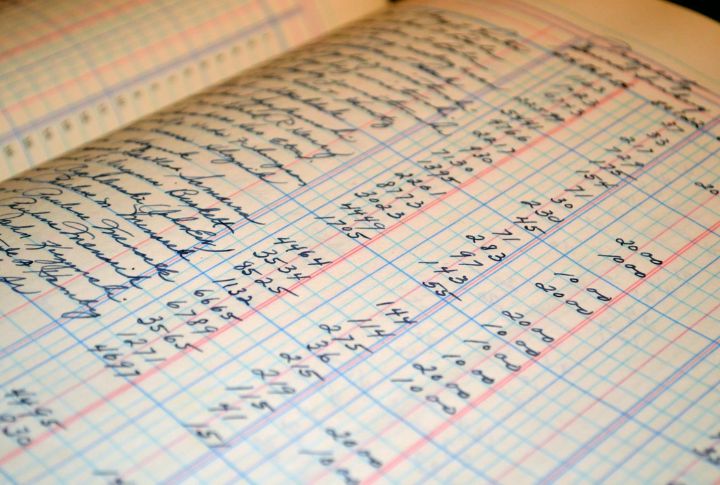

Keeping A Handwritten Ledger

Writing expenses by hand helps curb impulsive spending, and many users say it also strengthens memory and awareness. Benjamin Franklin tracked his spending this way, demonstrating its lasting effectiveness in helping build smart financial habits and maintain better control over money.

Buying Quality Once, Not Often

Instead of chasing deals, earlier generations focused on things that lasted. Depression-era consumers knew that one solid purchase beat several cheap ones. Cast iron pans from centuries ago prove their point. Choosing durability over disposability still stretches a budget and avoids endless trips back to the store.

Avoiding Subscription-Based Spending

Remember when people only paid for what they used? No monthly fees for TV or music—just simple pay-per-use, like renting VHS tapes. Today, the average person has about 12 subscriptions. Cutting back on subscriptions can simplify your budget and help avoid surprise charges.

Teaching Kids Money Through Chores And Allowance

Chores and allowances have long been used to teach kids how money works. Since the early 1900s, simple tools like labeled jars—save, spend, give—have helped build strong habits. These early lessons shaped adults who made thoughtful, responsible choices with their finances.

Cooking Nearly Every Meal At Home

Home-cooked meals were the norm in the 1950s, keeping costs low and processed foods off the table. Today, Americans dine out nearly six times a week. As Depression-era recipes trend again, cooking at home remains one of the smartest habits to revive.