Travel

How Long Will $500K Last In Retirement? A 20-State Comparison

We keep wondering, which is the best state to retire in? Where will our retirement savings stretch further? In some states, $500K lasts decades. In others, it barely even covers the basics. Taxes, housing, healthcare, day-to-day expenses, groceries, etc., shape the reality of retirement spending. Here’s what $500K plus Social Security gets you across these 20 states.

Alabama

Southern hospitality comes with an affordable price tag. Alabama’s low cost of living stretches retirement savings further than in many states. Housing is cheap, and groceries won’t drain your wallet. Even healthcare costs less here. Warm weather and friendly neighbors make Alabama an appealing place to make your money last.

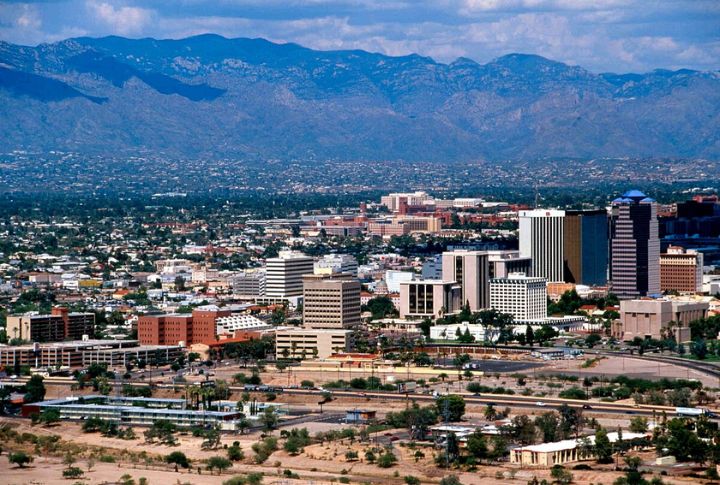

Arizona

Sunshine, cacti, and no tax on Social Security—Arizona has its perks. While housing costs in Phoenix and Tucson have climbed, smaller cities still offer budget-friendly options. Healthcare is a mixed bag, such that you get quality facilities with rising expenses. Dry heat and scenic landscapes create a balance between affordability and adventure.

California

Dreaming of a California retirement? Make sure your budget can handle it. The high cost of living and pricey housing eat into savings quickly. Even Social Security doesn’t go as far here. However, world-class healthcare and endless activities keep California attractive despite the price tag.

Colorado

Fresh mountain air and a booming economy make Colorado an attractive retirement spot. But affordability? That’s another story. Housing is expensive, and everyday costs add up fast. While Social Security is taxed, retirees 65 and older can deduct federally taxed benefits from state taxes, and outdoor enthusiasts will find endless free entertainment.

Florida

No state income tax and year-round beach weather make Florida a retiree favorite. Housing prices vary, with coastal cities being pricey but inland towns offering deals. Healthcare access is solid, especially for seniors. If you are looking for a mix of affordability and recreation, you will find Florida a great choice.

Georgia

Sweet tea and reasonable living costs: Georgia has a lot going for retirees. Property taxes are low, and Social Security remains untaxed. Big cities like Atlanta cost more, but smaller towns keep things budget-friendly. Affordability, combined with Southern charm, makes Georgia an appealing option.

Illinois

The Midwest offers an affordable retirement unless you’re in Chicago. The state taxes on retirement income and property taxes are high. However, smaller towns provide lower-cost living, and healthcare quality is solid. Those set on Illinois may find skipping city life the key to stretching savings.

Indiana

Simple and low stress. Indiana lets your money last. Housing is cheap, groceries are reasonable, and healthcare costs less than in many states. Winters can be harsh, but in case you don’t mind the cold, you will appreciate Indiana’s cost-friendly lifestyle.

Michigan

Great Lakes views without the high price tag? Michigan makes it possible. The cost of living is manageable, though winters can be rough here, too. Social Security isn’t taxed, and housing is relatively cheap. Bundling up may be a small price to pay for a long-lasting retirement fund.

Missouri

Low housing costs and cheap groceries make Missouri a practical retirement spot. The state does tax Social Security for some, but overall expenses remain low. Healthcare access varies by region, but affordability is a strong point. A quiet, cost-effective retirement is well within reach here.

Nevada

No state income tax is a win, but rising housing costs can be a problem. Las Vegas entertains galore, but living there isn’t as cheap as it once was. Rural areas are more affordable, though healthcare access may be limited. Nevada suits those who value tax perks and entertainment.

New York

New York City? Not unless you have deep pockets. But upstate New York is another story. Lower housing prices and a slower pace of life make it possible to stretch savings. Taxes are on the higher side, but small-town charm might just make upstate New York a smart choice.

North Carolina

Beach or mountains? North Carolina offers both at reasonable prices. Taxes are moderate, and the cost of living varies by region. Healthcare access is strong, and retirees flock to areas like Asheville and the Outer Banks. Variety and affordability make North Carolina a popular choice.

Ohio

A low cost of living and affordable healthcare make Ohio a strong choice for retirees. Those who prefer saving money over sunshine will appreciate what Ohio offers. Small towns and suburban areas provide budget-friendly living, which makes it easy to stretch that $500K.

Oregon

Kevin Crosby/Wikimedia Commons

Scenic beauty comes at a cost. Oregon’s lack of sales tax helps, but housing and everyday expenses run high. Social Security isn’t taxed, which helps balance things out. Outdoor adventures make Oregon a fulfilling (if somewhat pricey) retirement destination.

Pennsylvania

No tax on Social Security and reasonable home prices make Pennsylvania a popular retirement choice. Healthcare quality is strong, and living costs are manageable. Cities like Pittsburgh and Philadelphia are pricier, but smaller towns keep expenses low. History, seasons, and affordability make Pennsylvania stand out.

Tennessee

Tennessee has plenty to offer retirees, such as music and no state income tax. The cost of living is moderate, though housing prices in cities like Nashville have soared. Smaller towns remain affordable, and healthcare is decent. Southern hospitality and low taxes make Tennessee appealing.

Texas

No state income tax makes Texas attractive, but rising housing and property tax costs really cut into savings. Rural areas remain budget-friendly, while cities like Austin and Dallas demand a higher price. Choosing wisely means finding a balance between affordability and entertainment.

Virginia

Virginia has it all, from mountains to beaches. Living costs are moderate, though northern parts of the state are pricey. Taxes on retirement income exist, but they aren’t overwhelming. A mix of variety and moderate affordability keeps Virginia an interesting place to spend your golden years in.

Washington

Washington’s cost of living is high, even if there are no state taxes. Housing, in particular, is expensive. However, healthcare is strong, and outdoor recreation is abundant in this state. Those who can afford it will find Washington a stunning backdrop for retirement.