Money

10 Things Gen Z Does With Money That Are Surprisingly Smart

Think Gen Z is reckless with money? Think again. While older generations roll their eyes at viral money hacks and budget binders, today’s youngest adults are rewriting the rules of personal finance with surprisingly smart results. They’re saving in ways that work for them. Ready to rethink what frugal looks like? These clever habits might just inspire your next money move.

Cash-Stuffing Their Paychecks

Forget budgeting apps because TikTok has revived the old-school envelope method, and it’s stuck. Gen Z physically separates cash by category to prevent overspending. It’s a digital detox strategy that works. Color-coded binders labeled “groceries,” “fun,” and “rent” help them manage every dollar.

Splitting Subscriptions Strategically

Instead of paying for multiple services alone, Gen Z forms sharing groups to split app and streaming fees. It saves money and maximizes access. Spotify, Netflix, and Adobe are often divided up. Some even use spreadsheets to organize fair contributions and rotate payments.

Reselling Clothes After A Few Wears

Flipping clothes is more than a side hustle. Gen Z earns a steady income by reselling thrift finds through apps like Depop and Poshmark. There’s no need to restyle, as some items are sold as-is. Streetwear drops? Those can earn four times the original cost.

Skipping Car Ownership Entirely

Car ownership doesn’t appeal to much of Gen Z. Many rely on public transit, biking, or ridesharing to get around. It cuts costs and reduces hassle. For some, driving has never been necessary. This shift also aligns with eco-conscious and minimalist values.

Living With Roommates By Choice

Gen Z embraces co-living as a long-term lifestyle decision. Splitting rent isn’t just for broke college kids. Rent and utilities drop significantly with housemates. Matching apps help users find compatible living partners. Some shared homes now even function like mini-communities, complete with task charts.

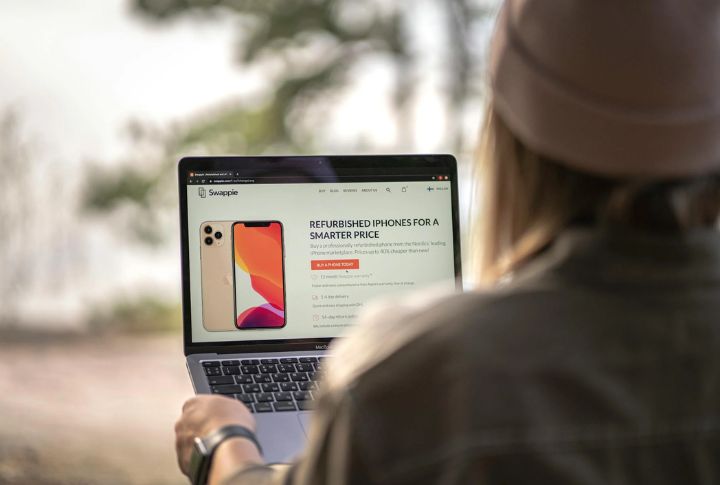

Buying Tech Refurbished Instead Of New

Refurbished phones, laptops, and tablets are in high demand among Gen Z, and savings often hit $300 or more per item. Choosing certified pre-owned devices can save hundreds per purchase. Many prefer older iPhones for their simplicity. In fact, refurbished “unboxing” videos draw big traffic online, reflecting a cultural comfort in used electronics.

Investing Via Micro-Saving Apps

Small-change investing is popular with Gen Z. Apps like Acorns and Qapital round up spare cents from purchases to build a portfolio. It’s an easy entry point to long-term savings. Even $0.47 from coffee runs can stack up, sometimes growing quietly into four figures.

Side Hustling For Lifestyle Goals

Gen Z runs second-income streams not just for bills, but for life goals. Freelance gigs like tutoring or dropshipping are treated seriously. Some began side hustles before age 18. Sticker shops on Etsy, for example, can generate enough revenue to fund entire vacations.

Making Budgeting A Game

Gen Z uses apps that gamify money goals, turning savings into points, streaks, or unlocked levels. Budgeting feels less painful when it’s fun. One app builds a city as users save. Some treat these achievements like high scores and compete with friends weekly.

Learning Financial Literacy From Social Media

Creators on YouTube and TikTok are Gen Z’s go-to source for money advice. Topics range from how to file taxes to building passive income. A whole genre, “FinTok,” now exists. Social media influencers often provide financial tips with more reach than school curricula.